Motorola's New Enterprises

Process and Strategy Assessment

| Prologue |

2 of 17 |

STRATEGIC RENEWAL

| Builds on proprietary World Class know-how | |

| May have significant synergistic potential | |

| May merge with or establish new Core Business in 10-20 years | |

| Not entirely alien to existing Operations | |

| Focused on customer needs and satisfactions | |

| Committed to high growth with low investment | |

| Expectation of high upside for contributors | |

| Champions' and key people's spirit is critical | |

| Strong cultures with free association and styles allowed | |

| Risks and failures accepted, but never indulged | |

| Insulated from Bureaucratic mentality and reporting | |

| Has high level mentor (CEO, COO, CFO, CSO,...) | |

| Encouraged to mix with Core Business people | |

| Commitment is long term (i.e., 10-20 years) | |

| Belief market will be huge someday | |

| Any existing market forecasts vary widely | |

| Technology pieces exist (in labs, at least) today | |

| Successful applications seem imminent | |

"Strategic Renewal is different than Tactical

Renewal!" 3 of 17

| A. | Study Origins | |||

| B. | Study Process | |||

| C. | Major Recommendations | |||

| D. | Study Team | |||

| E. | Interview Schedule | |||

| F. | Discontinuous Renewal Synopsis |

| A. | Strategy | |||

| B. | Relationships | |||

| C. | Arenas |

III. New Enterprises

| A. | Support Staff | |||

| B. | Venture Staffing | |||

| C. | Incentives |

IV. Portfolio

| A. | Venture Planning | |||

| B. | Venture Control | |||

| C. | Venture Harvesting |

V.

Deals

| A. | Deal Flow | |||

| B. | Selection |

|

4 of 17 |

I. Executive Summary

| A. | Study Origins | ||

Motorola's New Enterprises engaged

Pugh-Roberts Associates to undertake an assessment of its operation and

make recommendations to improve its performance. The Division in various

incarnations has been led by a succession of general managers starting

with Stephen Levy (1972-1975), then Robert Salatka (1975-1977), and Keith

Bane (1977-c.1980), and then the current Division was organized under

Levy Katzir (1982-1988). New Enterprises is committed to a fresh look

at Motorola's efforts to institutionalize discontinuous renewal.

|

|||

| B. | Study Process | ||

The Pugh-Roberts team took the

perspective, right from the start, that it was important to extract

what works and is valuable in what exists and what has been learned

and to go forward with a semblance of continuity. We resolved to

avoid the temptation to "start all over" but rather ventured

going forward given what has been done and is in place. We began by

interviewing venture personnel and Motorola corporate officers.

We got a sampling from Motorola operations. In all, we conducted 29

interviews, plus 5 interviews of New Enterprises' personnel. The

interview schedule is presented on the next page. We then presented

our findings to the New Enterprises' staff. With the benefit of

their feedback as well as the benefit of our involvement in and

ability to benchmark with other corporate venture organizations,

we wrote this report. |

|||

| C. | Major Recommendations | ||

The major recommendations are the following:

Although it is outside the scope of this consulting

engagement, we do strongly recommend that the investments made by New

Enterprises (or New Enterprises itself) be capitalized under an

investment holding company so that investments don't become treated

as Motorola losses. |

|||

| D. | Study Team | ||

The project leader was Jim Cook,

with significant participation and contributions by Ben Sykes and Carl

Kaminski. Alan Fusfeld was the Overseer of the project. Jim Cook

started two high technology companies, took one public, was on the

board of several high technology companies, was corporate staff Vice

President of Technology of Computervision and is now Deputy Director

of the Technology Management Group of Pugh-Roberts Associates. Ben

Sykes managed Exxon Enterprises ventures, was responsible for 37

ventures (12 of which were worth over $200 million publicly), and has

Senior Associate status with both New York University's Center of

Entrepreneurial Studies and Pugh-Roberts Associates. Carl Kaminski

was Director of Planning and Business Development for a McGraw-Edison

Division. Alan Fusfeld is a Senior Vice President of Pugh-Roberts and

the director of the Technology Management Group. |

|||

| Note about Organization: The

remainder of this report is organized by the subject of focus: a) Strategic

Value Added, b) New Enterprises, c) Portfolio, and d) Deals. In turn, each of

these sections is broken into its three most vital constituents, and each

constituent is reviewed from three perspectives: a) Observations and

Implications, b) Discussion and Best (or Worst) Practices, and c)

Recommendations. Note about Notation: We have rated

the criticality of "Recommendations" by the following legend: a)

C for Critical, b) E for Essential, and c) W for Worthwhile. We have

employed a * on "Recommendations" where we, Pugh-Roberts Associates,

could bring to bear special expertise. Throughout this report we have used:

a) M to mean Motorola, the company, b) Mops to mean Motorola's

operating divisions, and c) Mne to mean Motorola's New Enterprises

Division. |

|||

|

5 of 17 |

|

New Enterprises & |

Pugh-Roberts |

Logistics |

|||||

|

Ben |

Carl |

Jim |

Time |

Fl. |

Tel. # |

Fax # |

|

|

Ventures |

|||||||

|

4+ John Jones, Pres |

6/20 |

8 - 3 |

312/576-xxxx |

576-xxxx |

|||

|

3+ Elliott Philofsky, Pres |

6/5 |

9-5 |

707/763-xxxx |

765-xxxx |

|||

|

2+ Charles Loew, Pres |

5/31 |

602/437-xxxx |

437-xxxx |

||||

|

2+ John Brimm, Pres |

6/2 |

8:30-1:00 |

602/431-xxxx |

431-xxxx |

|||

|

Aaron Benaiah, Pres |

6/9 |

1:30-2:30 |

6 |

416/475-xxxx |

475-xxxx |

||

|

Corporate |

|||||||

|

Bob Galvin, CofB |

6/13 |

6/15 |

10-11 |

12 |

312/397-xxxx |

576-xxxx |

|

|

George Fisher, Pres |

6/15 |

6/15 |

2-3 |

12 |

312/397-xxxx |

576-xxxx |

|

|

Gary Tooker, COO |

6/15 |

2-3 |

12 |

312/397-xxxx |

576-xxxx |

||

|

Peter Lawson, CVP Legal |

6/16 |

10-11 |

11 |

312/397-xxxx |

576-xxxx |

||

|

Chris Galvin, CSO |

6/16 |

3-4 |

12 |

312/397-xxxx |

576-xxxx |

||

|

Keith Bane, SVP Strategy |

6/16 |

1:30-2 |

7 |

312/397-xxxx |

576-xxxx |

||

|

Jack Beaver, HR |

6/9 |

3-4 |

2 |

312/397-xxxx |

576-xxxx |

||

|

Levy Katzir, SVP |

6/15 |

6/15 |

11-12:30 |

6 |

312/397-xxxx |

576-xxxx |

|

|

Don Jones, CFO |

6/9 |

8-9 |

11 |

312/397-xxxx |

576-xxxx |

||

|

Operations |

|||||||

|

Ed Staiano, EVP |

Unavailable |

312/397-xxxx |

576-xxxx |

||||

|

Tommy George, SVP/AGM |

6/1 |

8-9:30 |

2 |

602/244-xxxx |

994-xxxx |

||

|

Mort Topfer, SVP/AGM |

6/15 |

6/15 |

3:30-5:00 |

312/397-xxxx |

576-xxxx |

||

|

External |

|||||||

|

Larry Doherty, VC |

6/12 |

6/12 |

3-5 |

6 |

508/435-xxxx |

none |

|

|

Bob Richardson, GM |

6/23 |

408/458-xxxx |

426-xxxx |

||||

|

Alan Kirson |

6/15 |

3-4:30 |

6 |

312/205-xxxx |

480-xxxx |

||

TOTALS |

14 |

3 |

18 |

|

|

30 Interviews Conducted |

|

|

6 of 17 |

Purpose: |

Find a repeatable method to achieve discontinuous renewal at Motorola. |

|

Apparatus: |

A dedicated organizational subunit (Mne), a charter, a plan, staff and budget, access to capital, a portfolio of ventures, and a means to generate deal flow. |

|

Set-up: |

The subunit (Mne) must be substantially autonomous of the sponsor (Mcorp). The subunit's charter must be endorsed by all parties on which the subunit relies. |

|

Procedure: |

Make prudent, promising investments in the portfolio ventures and deal flow as prescribed by the Charter. Monitor and offer direction and assistance to portfolio ventures. Divest interests in the ventures when they no longer offer promise, when they become commercially successful, or when it becomes mutually beneficial to be run as or under a new M group or sector. |

|

Hypothesis: |

The current processes will yield gains in shareholders' value in excess of other risk-adjusted alternatives consistent with the sponsor's constraints (line of business, policies, absolute risk threshold, ethics, and national societal and humanistic concerns). |

|

Findings: |

The shareholders' value is unmeasured, but is not in excess of alternatives, as qualified above. In some instances, the shareholders' value has appreciated commensurately (Tegal and Emtek). The strategy and management process are missing. |

|

Assessment: |

Discontinuous renewal is the only way to have a multi-century corporation (note: Berretta in manufacturing, Corning in joint ventures, Coca-Cola in merchandising, AT&T in technology). The seeds of repeatability must be in the successes. The management process of the procedure has been lax. |

|

Next Steps: |

Create a strategy and adopt a management process based on the wisdom of experience and the insight of perceptions. Devise a measurement basis related to shareholders' value. Employ time frames consistent with the phenomena being measured. |

|

Expectations: |

Successes should become more repeatable as good method (discipline and some rigor) is applied to good process. A good measurement method for risk-adjusted shareholders' value should reduce the time needed to see results (perhaps from 5 to 7 years down to 2 to 3 years). |

================== End of Chapter I - Executive Summary

===================

|

7 of 17 |

| A. | Strategy 1. Observations and Implications |

||

|

The 1988 Annual Report says, "The New

Enterprises organizations' charter is to enter completely new

businesses in emerging high growth, high technology arenas."

The appearance of this statement in the Annual Report dramatizes

the importance of a charter but, by no means, signifies the

strategic intent. We could not find a comprehensive strategy,

and so, we assumed that none exists. Without a clear strategy,

Mne's direction, legitimacy, and viability can always

be called into question, both inside and outside of

M. Strategic Renewal is a need widely recognized by the

senior management of M and forcefully fostered by Bob Galvin.

However, we found no clear connection between Mcorp's overall

strategy and Mne's purpose. The condition of a forceful mentor

and a strategy disconnect has been correlated with the demise of

corporate venturing elsewhere. This can, and often does, pre-empt

the actualization of investments because of the lapse in long

term support. The absence of a strategy and management process and

some other basics were mentioned in the interviews. Specifically,

it was mentioned more than once that Mne lacked a crisp

statement of its strategy, a thought out plan, and the discipline

to adhere to them. This is a constructive criticism with the obvious

invitation to be turned around. Barring the installation of

these basics, however, reduced support is to be the expected

consequence. As a substitute for a strategy, financial criteria for

investing and the overall performance of Mne were promulgated.

These criteria served as operational guidelines and as vehicles to

demonstrate the direction and legitimacy of Mne. Some of the

criteria were indeed helpful, for example: a) focus on software,

electronics, and factory automation, b) total initial investment of

less than $6 million in any one venture, c) investment limited to

ventures in emerging markets growing faster than 50% per year and

of total size between $50 million and $200 million. Other criteria

hurt Mne's credibility, such as: a) aggregate venture sales

of $1 billion in 10 years, b) very profitable industry (i.e.,

attractive) where acquisition can be made at a low level of investment

(i.e., cheap), and c) large experienced (and emerging?)

companies not participating despite high margins. The presence of

unachievable and mutually inconsistent objectives undermines

Mne's credibility. M has clearly embraced the view that

"Strategic Renewal is different than Tactical

Renewal." Furthermore, Strategic Renewal has the support

of Mcorp and an unusually high degree of support from

Mops. This has sustained Mne through some tenuous times,

but now is a good time to reduce the reliance on this article of faith.

|

|||

2. Discussion and Best (and Worst) Practices |

|||

|

New venture arms in large corporations are created as

separate entities to provide: a) a center of responsibility focused

on growth by venturing, b) appropriate organizational climate and

structure to foster emerging businesses, and c) insulation from the

dominant values, concerns, norms and bureaucracy of the maturer

businesses. The root cause for separating large corporations'

main line businesses from corporate venturing is corporate

asymmetry." That is, the differences between emerging ventures

and established divisions are so stark with respect to predictability,

planning, funding, evaluation, objectives, time frames, structure,

administration, and culture as to cry out for them to be managed

separately until the "emerging" becomes

"established." A chemical company's venture arm established a venture

strategy in the absence of an overall corporate strategy and got

tacit approval and recurring vacillation. The activity was then

viewed as out in left field and later as an elitist clandestine

operation. When the parent company's president retired, the venture

arm was disbanded. DuPont changed its strategy from diversification to

consolidation around 1970. The corporate venturing did not change

its strategy (it could have begun investing in start-ups exploiting

advanced technology in its main line markets, for example) which is

why it lost support and was nearly disbanded. Unrealistically short

time spans and large sales expectations also undermined support for

DuPont's corporate venturing. "After we painfully learned that ventures might

take 15 years to pay off, we adopted the practice of making ventures

self-supporting early on. Furthermore, we withhold making large

investments until both market acceptance and financial return have

been demonstrated," according to the Development Controller of

DuPont. Ralston Purina adopted a realistic charter which set

forth: a) scope, b) objectives, c) the venture process, d) structure,

e) conflict resolution, and f) end game. The executed plan, which

resulted in a major new division of the company, helped Ralston be

recognized by Dun's Review as one of the five best managed companies

in America. (A very worthwhile case study.)br> |

|||

3. Recommendations ( C = Critical, E=Essential, W=Worthwhile; *=Pugh-Roberts can help ) |

|||

|

|||

|

8 of 17 |

| B. | Relationships 1. Observations and Implications |

||

|

Mcorp and Mops review, at least quarterly, division by division earnings performance. This is an inappropriate and counter-productive basis on which to portray Mne. Inappropriate because Mne's ventures are emerging and almost by definition are losing money, but creating shareholder value. Counter-productive because support for Mne is undermined. Mne has not exploited Dan Noble Fellows nor the M Science Advisory Board members to get leveraged relationships and networking mileage. These and some additional formally and informally recognized individuals could be "magnets" for ideas and, potentially, deal flow and "intelligence" from within the network of M employees everywhere. Mne has had numerous instances of good relationships with Mops, particularly APRDL and the Semiconductor division. In the past, there has been some serious strains due to heavy-handed pressure, overstated claims by Mne about ventures' products, and the perception that Mops could make much better use of investment funds. The continuation of good relations with Mops is vital to Mne's ability to leverage Mops' World Class technical capabilities. This is an important comparative advantage of Mne ventures over venture capital backed ventures. Mne doesn't have the time to cultivate relationships inside Mops because Mne is understaffed. Consequently, one of the vital resources of Mne, namely leveraging Mops' talent and know-how, is languishing. Mne relationships with venture capitalists is non-existent. This can be explained by: +a) Mne has no option for shared ownership, b) Mne has no framework or basis for a relationship, and c) Mne does not have a clear venture strategy for them to relate to. By not establishing links with the venture capital community, Mne is foregoing one of the best sources of deal flow, talent and assessment. Historically, Mne has sought out potential key people by networking within the industry and using proven search firms. This has been sporadic, but effective from time-to-time. Mne has not networked with academics, consultants, and/or luminaries, to date. Networking to obtain talent, ideas and assessments is a vital part of venturing and is why we will be recommending that Partner/Gatekeepers be added to Mne's staff (Gatekeepers are consummate networkers). |

|||

| 2. Discussion and Best (and Worst) Practices | |||

|

Kodak populates each geographic location with a trained "facilitator" who is available to package ideas from within Kodak's operations for funding by Kodak's New Opportunity Division. Furthermore, on a systematic basis, ideas for businesses unrelated to existing businesses which are rejected by line divisions are reviewed by the New Opportunity Division. One chemical company's corporate venturing operation engendered the following attitudes: a) "another mouth to feed," i.e., a competitor for capital, b) "hot area," i.e., its limelight generated unrealistic expectations and jealousy, c) "the brightest young people in the company," i.e., line operations are inferior, and d) not surprisingly, it had very little grass roots support. Consequently, the corporate venturing arm received virtually no line cooperation which prevented its ultimate success. Ralston Purina corporate venturing exploited an extensive network of contacts in the corporate R&D organization. This effective networking was an outgrowth of previous associations of the corporate venturing leader. Business cases indicate that a crisis of relationships occurs when the venture arm experiences disappointments which, in turn, discourages relationships out of concern for being tainted. On the other hand, repeated successes by the venture arm raises the spectre of a potential, threatening competitor (of the line operations) for talent and resources, also resulting in a deterioration, and even crisis, in relationships. Three mechanisms have been cited to improve relations between corporate venturing arms and corporate operations. They are: a) a prestigious "Resource Board" composed of talented operating personnel, b) reducing the elitist status associated with corporate venturing, and c) reduction of lavish levels of funding, (e.g., in one instance, from hundreds of millions per year to tens of millions per year). Relationships are vital for intelligence gathering regarding deals, talent, competitors, substitutes, technology, and events. The more key sources you are in touch with, the better your chances of success. |

|||

3. Recommendations ( C = Critical, E=Essential, W=Worthwhile; *=Pugh-Roberts can help ) |

|||

|

|||

|

9 of 17 |

| C. | Arenas |

||

|

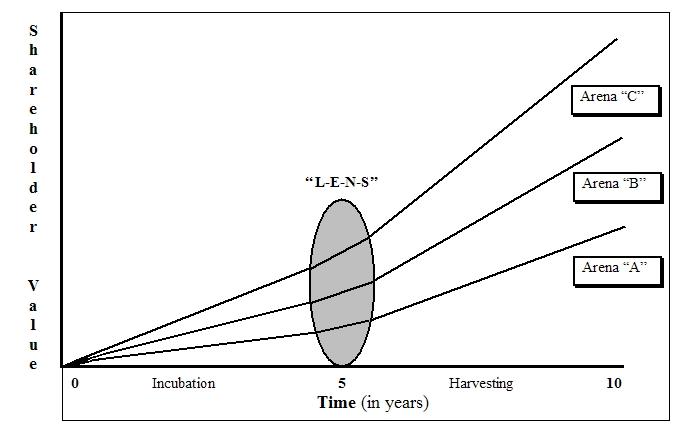

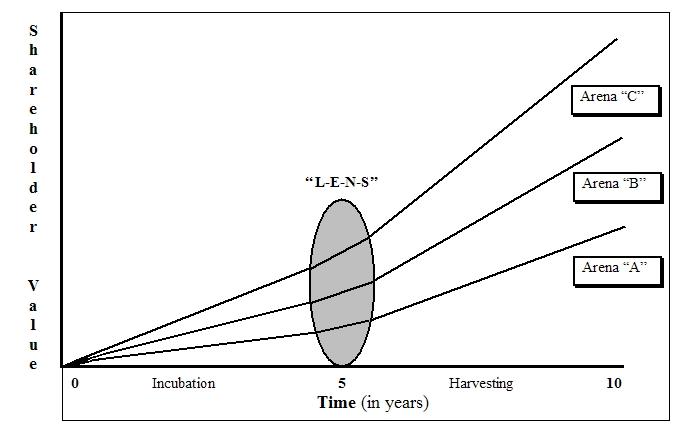

The arena (or cluster) concept for corporate venturing proposes

that a group of ventures be started or acquired, each of which is in a field

related to one or more of the others. The relationship could be based upon

complementary technologies or markets. Because of the relationship, each

venture can benefit from the complementary capabilities of the others through

cooperation on technical and/or marketing issues. |

|||

1. Observations and Implications |

|||

|

The arena concept began with expectations of concentrated competency within prescribed venture investment areas. Later, this concept was further leveraged as a facilitator of transfers between ventures, cooperation between people in corresponding functions (of different ventures within the same arena), and sharing of technical platforms among ventures. The transfers did not take into account "aculturation" issues which delay the effectiveness of transfers. The co-operation simply did not materialize because venture staffs did not have the time. The sharing of platforms was a disaster because it was imposed forcefully on the ventures and, because it was not "solid," it jeopardized the venture The arenas are: a) health care systems, b) factory automation, and c) semi-conductor fabrication equipment. Health care systems and factory automation were chosen because they both are emerging markets where mobile communications can yield a competitive advantage. Semiconductor fabrication equipment, on the other hand, was chosen for corporate strategic reasons and not for reasons rigorously tied to Mne's charter. The result is Mne is somewhat tainted as a refuge from tough business practice and not focused on "discontinuous renewal." Mne does not have significant expertise or networking capability in each of its arenas. This lapse prevents Mne from having the requisite fluency to integrate and relate what is happening in the marketplace and the ventures. (Later we recommend a Partner/Gatekeeper for each arena as part of an overall Mne organization.) |

|||

2. Discussion and Best (and Worst) Practices |

|||

|

The "arena" concept is almost universally applied by venture capital firms. Applied to the venture's funding organization it has conspicuous benefits. For example, the management supervising the overall venture program can build a background of knowledge about a selected business arena thereby improving their awareness of new opportunities and their judgment about competitive developments and trends. Given time and patience, it also allows the testing and development of new managers, and the maturation of ventures, one of which may in the future become the core around which to form an integrated, consolidated new business division. However, applied outside the funding organization, that is, between ventures within an arena, and the theoretical synergies get overridden by the empirical realities. Those empirical realities were experienced when Exxon Enterprises tried to merge several of its ventures within an arena. The resulting experience has been categorized as being caused by "technology mis-match" and "rampant individualism." Technology mis-match can occur for two reasons. The technology development stage of venture "A" may not match the needs of the proposed user, venture "B", or "A's" technology may not be optimum for "B" compared to a competitive technology available from a competitor to "A." Forcing "B" to use "A's" technology can delay "B's" product introduction, or, worse, cause it to be non-competitive. Meanwhile "A" is under a lot of pressure to meet "B's" needs, which may not be the optimum market for "A" to initially target. Consequently, both ventures suffer. Rampant individualism is a more complex problem to diagnose and deal with. It results in a venture's management putting their venture first versus the over-all good of the arena. This behavior is fostered by the entrepreneurial environment most venture programs try to create, namely, autonomy and all-out effort to make the venture successful by the most expeditious means available. Cooperation and subordination to the needs of the whole is a corporate behavior. The only cooperation of interest to the entrepreneur is a relationship that will move the venture faster and surer to its goal. The odds are that the optimum relationship for the venture will be with an outsider who has exactly what it needs when it needs it. M has had success with informal corporate venturing which resulted into its semi-conductor and cellular phone successes. One was technology driven, the other was market driven. Both were based on outside technology (from Bell Labs), both had long gestation periods (10 to 20 years), and both took over 10 years (even after gestation) to become $1 billion businesses. Finally, both were related to the Mobile Radio business and had the personal support of the Galvins. |

|||

3. Recommendations ( C = Critical, E=Essential, W=Worthwhile; *=Pugh-Roberts can help ) |

|||

|

|||

================== End of Chapter II - Strategic Value Added

===================

III. NEW ENTERPRISE OPERATIONS - Mne Support Staff |

10 of 17 |

| A. | Mne Support Staff | ||

1. Observations and Implications |

|||

|

Historically, the Mne staff has played too strong a role in the ventures' day-to-day operations. This excess has been reversed, although there is still an instance where this persists. Three results of this are: a) Mne staff takes the urgency out of the venture filling its staff vacancies, b) ownership and accountability of the ventures' destiny is not internalized by the ventures themselves, and c) Mne neglects its responsibilities while focusing on just one venture. Today, Mne is short-handed to a fault. Mne needs to develop and promote a strategy, staff Mne according to the needs of the strategy, determine the direction and disposition of its portfolio, enrich its networking, and devise a useful system for measuring portfolio progress and value. Not until the foregoing are in place will the business of discontinuous renewal be able to progress. The Mne support staff has not had the time to nurture the linkages within Mops (other than a few forced encounters) nor has it developed much in the way of external linkages. Consequently, access to leverage and technology transfer has not been facilitated by the Mne staff. However, venture personnel have taken the initiative to develop their own linkages and one Mops executive publicly "buried the hatchet" and encouraged mixing with venture personnel with good results. |

|||

2. Discussion and Best (and Worst) Practices |

|||

|

Kodak's venture arm (New Opportunity Division) has two kinds of portfolio managers: seed managers and venture managers. Seed managers are recruited from Kodak's technical and marketing ranks and are selected for their business acumen, business experience and their ability to put a venture together. Venture managers are selected for their experience managing in a start-up or small business environment. A DuPont New Business Opportunity manager describes his job as, "identify the resources that are needed for a venture, determine if DuPont has enough of these resources to be successful, then pull them together and try to manage them. You do better when the business you're aiming at is close to what you already know." (This can be called into question as being excessively proactive and pre-empting the entrepreneurs from entrepreneuring.) At DuPont, most of the individuals had technical backgrounds and many worked in the Development Department (DuPont's corporate research arm) during the prior decade. A typical individual was described as, "someone with commercial savvy and a background with different departments within DuPont." DuPont later hired newly minted MBA's directly into the Development Department as a way to give them a quick overview of DuPont. Venture Capitalists and, more recently, IBM have realized that building high technology ventures is a complex art which is hampered, not helped, by unwelcomed support. Rather, they attach a partner to nurture, mentor, network and manage a portfolio of investments. |

|||

3. Recommendations ( C = Critical, E=Essential, W=Worthwhile; *=Pugh-Roberts can help ) |

|||

|

|||

III. NEW ENTERPRISE OPERATIONS - Mne Venture Staffing |

11 of 17 |

| B. | Mne Venture Staffing | ||

1. Observations and Implications |

|||

|

M's strong people sensitivity was felt and appreciated at all the ventures. By and large, the effect has been to foster loyalty, good feelings, and reduce anxiety about how venture personnel will be treated. It has also helped attract experienced management personnel to the ventures. Mne has shifted its emphasis in its venture oversight from technology,per se, to management. The high quality of recent hires reflects this trend, although there is some need, however, for expertise in specific market areas. The consequence of not having this expertise is the costly learning on the job, the risk of culture shock, and the absence of a network. In the past, Mne has under-emphasized management evolution. This is, again, more a matter of placing the emphasis on technologies rather than developing managers to manage those technologies. Recently, there has been a lot more stress on recruiting experienced higher level managers. Transitioning from the technical entrepreneur to professional manager is always a problem. The absence of addressing this issue has probably caused the greatest loss of opportunity to emerging ventures. Just look at how Apple Computer almost went under due to the excesses of its entrepreneurs. The ventures do not report to their Boards of Directors and those Boards do not even meet quarterly, but rather only annually as stipulated by law. Most of the ventures do not have Mops members on their Boards. The customary functional quarterly situation reports and annual plans presented to Boards of most high technology companies transpire, instead, on a quarterly basis directly with Mne. This causes the venture to feel as though it reports to Mne and is not an entrepreneurial venture. As mentioned elsewhere in this report, the usual sources of leads to finding talented and available key managers are not highly developed by Mne (primarily due to Mne under-staffing). Mne should not be confident that it has attracted the best managers available to its ventures although Mne has done relatively well. However, venture staffing is what "makes or breaks" most ventures. In one Mne venture, when management was recruited, the managers were each from different cultures, which has made working together very difficult. One manager said that if he ever started a venture again it would be with a team that knew each other and had learned to work together. Also, he would be sure the venture team made the plan as opposed to being brought in to execute a plan some one else drew up. The 1982 SRI Report also made the worthwhile suggestion that each venture should have a Board of Directors composed of members who can be of assistance to the venture including help from related base business areas. This was not implemented. One interviewee's speculation is that Mne did not want to give up the degree of control such an arrangement inferred. |

|||

2. Discussion and Best (and Worst) Practices |

|||

|

Boards of Directors are effective vehicles for bringing together Mops supporters, outside luminaries, the venture's leadership, and Mne's Partner/Gatekeeper. This is rosy until the venture gets into difficulty (as IBM found out). However, the antidote is to be sure the Board has some on the spot wherewithal (read discretionary investment) to affect the challenges facing the venture. Venture Boards (at Kodak) have been chartered to: a) facilitate the movement of people, b) smooth the transition of the venture into an existing operation, c) provide actual expertise or linkages to expertise vital to the venture, and d) challenge the venture from an external perspective. When the ventures need decisions, you need a Board to make a decision and not have to go through several levels of review. One of the things that IBM does is put on the Board at least one person who has the authority to say, "yes, spend the money." The only thing that this Board has to do outside of that is inform the corporation if they're changing strategy. GE, 3M, and Kodak among others have come around to an opinion that the best thing that they can do is to leverage other corporate capabilities, knowledge, people and skills. The further that you are from your existing business, the fewer opportunities there are to capitalize on the leverage. One of the best ways to have a uniform culture and to solve the communication problem is to staff your own organization, as IBM and 3M has done. It does not work if you are going into new areas where you need to reach outside for that experience. The best measurement of management quality is track record, a measure the venture capitalist uses to decide whether to financially back a venture. Track record is primarily an experience factor. There are two important aspects to experience: general managerial experience and experience with a specific market or technology. The venture capitalist wants a management team that has demonstrated capability to manage a high growth, high potential venture. Equally important, the venture capitalist looks for expertise in the markets and technologies in which the venture intends to compete. |

|||

3. Recommendations ( C = Critical, E=Essential, W=Worthwhile; *=Pugh-Roberts can help ) |

|||

| REDACTED | |||

III. NEW ENTERPRISE OPERATIONS - Mne Incentives |

12 of 17 |

||

| C. | Mne Incentives | ||

1. Observations and Implications |

|||

|

On no occasion during our interviews was the Equity Participation Plan (EPP) cited as a motivator (other than signing on). The universal disenchantment derived from the perception (and usually fact) that the EPP was based on an overly optimistic business plan drawn up by some third party and, furthermore, the business direction had been changed by Mne without any concomitant EPP adjustment. The implication is the loss of the motivational value of participating financially in the success of the venture (i.e., making all those late nights and weekends worth it to themselves and their families). In one interview with a venture's manager, he said he felt that he was sold a "bill of goods" when he was recruited. He said he had assumed that Mne must know what they were doing, only to later discover that the business plan had no chance of being achieved and had been put together by an outside consultant. He felt particularly demotivated when at progress reviews, Mne would open by citing the growth records of such companies as Apollo. The implicit expectation was that they would perform similarly. The spirit of the entrepreneur is dampened by these tactics. Mne has, in the past few years, attracted senior experienced managers to head several of the ventures and to fill key functional slots. Nearly all of these new managers have come from outside M. Data from our interviews indicated that these managers were attracted to M by a "package" of features among which the following were most important: a) generous starting salaries b) up-front compensation for forms of deferred compensation lost because of leaving former employers c) the implied security of being part of a large, successful corporation versus the assumed greater risk of working for an independent, venture capital sponsored start-up d) the opportunity to work in an entrepreneurial environment e) participation in the EPP and f) the assumed financial, marketing and technology support available from M and Mops. The EPP did help attract these superior managers. The generous starting salaries were also a factor. However, the EPP has not paid off for anyone. The EPP was graciously criticized by several ventures' managers for representing too small a proportion of the venture's equity and for not being more widely shared within the venture. Several venture managers expressed the view that they would like everyone in the venture to have an equity stake. In the past, Mne has changed ventures' strategic direction, product specifics and time horizon without corresponding change in the EPP of key people. But more importantly, the key people do believe that if they achieve the business plan they will realize the benefits from the standpoint of the equity pay off. However, when Mne comes in and tears up the business plan as it had done in the past, and says that the venture is going to go off in a new product direction which will not materialize within the targeted time frame, it wreaks havoc with motivation. We did not assess the incentive plans of the Mne staff, although with the recommendation to hire Partner/Gatekeepers, we will comment below. An Mcorp officer observed that the EPP should be consistent with M, that perhaps M should have a high upside option (such as royalties, perhaps) for star performers within M. |

|||

2. Discussion and Best (and Worst) Practices |

|||

|

Incentive compensation is only one part of the total issue of motivation. There are two forms: psychic and cash. Psychic forms have proven to be the strongest and most lasting. They include individual and team achievement, recognition for the achievement, and increased power (as in promotion to greater responsibility). The opportunity to have significant autonomy and independence in making decisions and implementing a plan that the individual participated in developing is the essence of the entrepreneurial environment. 3M has a scheme where the magnitude of the commercial success determines the career advancement of the participants. Cash awards vary from straight salary, through bonuses to equity type participation. As a rule of thumb, the more highly related the business is to the parent company business, the closer the form of cash compensation should be to the base business forms of compensation. This makes it easier to transfer employees to and from the ventures as needed, and reduces the problems of "fairness" when the Mne staff personnel or other M employees provide significant contributions to the venture's success. A bonus/milestone type of compensation makes it easier for the corporation to impose changes in strategy on the venture without renegotiating the incentive plan each time. Such changes can be made at each milestone completion. If the venture is and will remain totally independent from the parent company, relying almost entirely on outside personnel for management, then an equity form of compensation may be appropriate. The key issue then is what it takes to be competitive. If the venture is competing with the venture capitalist for "world-class" personnel, then some form of equity may be required to attract the best personnel. Venture capital firms typically employ one general partner and one-half to one professional assistant for every $10 to $20 million of investment in early stage ventures. The typical, annual management fee runs 2.5 to 3.0% of the capital managed. This excludes the formation costs and legal expenses associated with sale of assets (such as when a venture goes public). The operating costs for seed capital firms run much higher, as much as 10% of capital managed, because of the high ratio of effort to initial dollars invested. Seed capital firms typically collect part of these expenses by direct charges against the ventures rather than the Partnership. |

|||

3. Recommendations ( C = Critical, E=Essential, W=Worthwhile; *=Pugh-Roberts can help ) |

|||

|

|||

================= End of Chapter III - New Enterprise Operations

=================

| IV. NEW ENTERPRISE PORTFOLIO - Mne Venture Planning |

13 of 17 |

| A. | Mne Venture Planning | ||

1. Observations and Implications |

|||

|

REDACTED |

|||

2. Discussion and Best (and Worst) Practices |

|||

|

At Kodak, the typical business planning process requires an assessment of the industry structure and dynamics, and of the would-be venture’s competitive advantage this is followed by the development of alternative strategies and preparation of a staged operating plan. During the business development phase, a "strategic sponsor" for the new business (at the company officer level) must be found in order to provide assurance that the new business will be of strategic corporate interest, should it succeed. The business development phase extends to the point where a management team is in place, a complete business plan is in hand, and targeted customers have shown a willingness to buy the venture's products) on the basis of having evaluated a working prototype. Of the 30-40% of the seeds that have survived this phase, about 85% were commercialized (or otherwise adopted) by an existing Kodak organization, with the remainder going to the Venture Board for approval. In virtually all venture capital situations, the venture is expected to produce its own business plans including market research, financial projections, development milestones and contingencies. To have a plan professionally made, even in part, by someone outside the key people seriously impairs the venture's credibility. Exxon Enterprises achieved excellent returns on its minority held positions ($218 million on $12 million invested over 10 years) and dismal returns on its internal ventures which were cursed with the burdens of both worlds: funding justification based on milestone reviews (as with venture capital) and budgetary reviews on an annual basis (for Exxon's corporate planning). The level of planning should actually change as the venture progresses. In the beginning it must be thoroughly researched, later the assumptions of the plan are diligently monitored and the venture adapts to its environment fluidly (not necessarily according to the letter of the business plan). In later stages (launch and ramp-up), planning and control should be attended to diligently. Excessive planning defeats the flexibility necessary for entrepreneurial success, too little planning wastes resources and opportunity. The degree of planning (as with control) varies according to the stage of the venture. |

|||

3. Recommendations ( C = Critical, E=Essential, W=Worthwhile; *=Pugh-Roberts can help ) |

|||

|

|||

| IV. NEW ENTERPRISE PORTFOLIO - Mne Venture Control |

14 of 17 |

| A. | Mne Venture Control | ||

1. Observations and Implications |

|||

|

REDACTED |

|||

2. Discussion and Best (and Worst) Practices |

|||

|

The venture capitalists expect venture managers to develop the business plan and make all operational decisions. They exercise control through voting changes in the management and through the withholding of financing. Usually they finance by milestones, not on a calendar basis. The venture's final milestone is the initial public offering. The driving force for ventures, even for a corporation sponsored ventures, should be to achieve early commercial viability through proof that there is a market for the product, that the market has enough growth potential to justify the venture effort, and that the profit margins will provide acceptable return on investment over the long haul. The venture should not be forced to grow at a preset target rate. Start-up ventures should be measured by the achievement of tactical milestones. Typical milestones are: A) completion of prototype accompanied by assessment of manufacturing cost b) fabrication of pre-production samples for market test accompanied by market acceptance evaluation and pricing assumptions c) first sale to lead customer(s), etc. The business plan and the overall strategy must be reassessed after each critical milestone, quite possibly resulting in a change of direction. The focus is on learning from and responding to the feed-back from the segment of activity leading to a milestone. The plan is revised to fit what was learned, not to force achievement of what was originally projected (e.g., by increasing R&D expenditures or doubling the number of sales people). Obviously, tactical venture milestones do not often coincide with the corporate budget cycle due dates. Although the corporation needs budget forecasts on a periodic basis for financial planning purposes, these dates should not be used for stewardship of individual ventures. Milestones also afford an opportunity to assess the performance of venture personnel and anchor incentive compensation awards. Managers can be changed or added to meet the needs of the next development phase. Bonuses can be given to those who contributed to the milestone achievement. New bonus awards can be formulated for the next milestone, rather than for a four to five year business development span. A new venture may move from high technical challenge, through engineering and manufacturing challenges and then on to marketing and administrative challenges within such a time span. |

|||

3. Recommendations ( C = Critical, E=Essential, W=Worthwhile; *=Pugh-Roberts can help ) |

|||

|

|||

| IV. NEW ENTERPRISE PORTFOLIO - Mne Venture Harvesting |

15 of 17 |

| A. | Mne Venture Harvesting | ||

1. Observations and Implications |

|||

|

REDACTED |

|||

2. Discussion and Best (and Worst) Practices |

|||

|

Sometimes called the "end-game," the ultimate transition of a venture from the protection of Mne can be viewed as "harvesting" the crop that was seeded and nurtured by Mne. The venture can be left alone as a stand-alone new business or integrated into the base business. That will depend on how closely related it is to the base business and the degree of leverage the base business can give, and vice versa. If the venture no longer appears to be of strategic interest to the corporation it can be spun-off. This can take a number of forms, depending on the financial viability of the venture. M could retain an equity interest for its ownership value and let the venture seek ongoing financing from the outside, or M could sell the venture outright. Joint venture is also an alternative. The appropriate course is highly dependent on the specific circumstances. The timing of a transition from Mne is equally dependent on circumstances. If leverage from the base business could be of significant value early on, then the transfer should be made earlier. Acceptance by the "home" division should be cultivated well in advance, as for example, by putting a key manager from the existing function on the Board of the venture. Another possible transition would be to subordinate a weakly managed venture to stronger venture in a related arena (e.g., semiconductor equipment). |

|||

3. Recommendations ( C = Critical, E=Essential, W=Worthwhile; *=Pugh-Roberts can help ) |

|||

|

|||

================= End of Chapter IV - Portfolio

=================

| V. DEAL FLOW & SELECTION - Mne Deal Flow |

16 of 17 |

| A. | Mne Deal Flow | ||

1. Observations and Implications |

|||

|

REDACTED |

|||

2. Discussion and Best (and Worst) Practices |

|||

|

Best deal flow results can be traced to having a mix of approaches. An optimum mix includes: a) co-investment with venture capital firms, b) sponsoring of university research, c) underwriting an internal innovation program, d) top management listening and enabling, and e) involvement with customers and/or suppliers. The primary objective is to develop a rich, informed and expeditious network of sources for deals (and selection). By co-investing with venture capitalists in classical high technology ventures, corporations can have the opportunity to gain a working knowledge of those emerging technologies and markets that are expected to achieve commercial success within five to seven years. These corporations should resist the inclination to acquire and/or control the ventures, but rather should cultivate ways of working together in mutually beneficial ways. Acquisition should be an option to be executed only at such a time as it becomes mutually beneficial (which might just be a matter of price or time or both). Corporations go about co-investing with venture capitalists in two ways: a) direct investment on a deal by deal basis, or b) by making a blanket investment in the venture capital limited partnership (VCLP). It is common to do both VCLP's range from broad based partnerships which invest in several arenas and have several corporate limited partners to those which focus on one arena and have only one corporate limited partner. The participation requires would be $2-3 million for each broad based partnership, and $10-30 million in the highly focused partnerships. The best practice for an Internal Innovation Program is the bottoms-up program created by Bob Rosenfeld while at Kodak. At each technical and/or marketing location, a trained "facilitator" is available to help Kodak people develop and package product or business ideas into presentations to funding sources inside Kodak. Ideas related to existing business are presented to the line operating divisions. Unrelated ideas and rejected related ideas are reviewed by the New Opportunity Division (similar to M's New Enterprises). Top Down Listening and Enabling is best done by Corporate management who are in a position to set major new strategic directions. Often middle management will suggest these new directions, but nothing happens unless there is a willingness to invest corporate resource in pursuing the idea. Such an idea was suggested at IBM and resulted in top management giving the go-ahead and management resource to create the Entry Systems Division. M's semi-conductor business evolved in a similar fashion. M has itself been a Best Practice in customer and/or supplier involvement as a source of ideas for new products and businesses (AT&T for cellular, IBM for mobile computer communicator, and the US Government for encryption). Except from venture capital sources or "'finders", most deals will not come to Mne fully formed. The sources we have suggested provide the network of contacts for putting together potential deals, and then with Mne and M legal support as investments. The best deals will be those created, for example by finding and then encouraging a team of market knowledgeable entrepreneurs to form a venture. |

|||

3. Recommendations ( C = Critical, E=Essential, W=Worthwhile; *=Pugh-Roberts can help ) |

|||

|

|||

| V. DEAL FLOW & SELECTION - Mne Selection |

17 of 17 |

| B. | Mne Selection | ||

1. Observations and Implications |

|||

|

REDACTED |

|||

2. Discussion and Best (and Worst) Practices |

|||

|

Any selection process which does not incorporate or leverage the distinctive competencies of the sponsor (i.e., M) misses the differentiating opportunity for adding value. The first requirement of ventures is financial viability which should be based on the track record of the management, the margin potential of the product, the market share prospects, and the viability of the proposed marketing channels for distribution and service. |

|||

3. Recommendations ( C = Critical, E=Essential, W=Worthwhile; *=Pugh-Roberts can help ) |

|||

|

|

|||

================= End of Chapter V - Deal Flow =================

================= END =================